This feature is only available from Sage 200cloud Professional Summer 2019 version onwards. If you are unsure which Sage 200 version you’re currently using please see our online guide (opens in new tab).

As of March 2021, those working in the UK’s construction industry might have to handle and pay VAT in a different way following the introduction of the new VAT reverse charge system for the Construction Industry Scheme (CIS).

For supplies of certain specified construction services, the customer will be liable to account to HMRC for the VAT for these purchases instead of the supplier. The reverse charge will include goods, where those goods are supplied with the specified services.

- For full compliance with the CIS, you will need to use a third-party CIS module for Sage 200cloud.

- CIS is only applicable for companies in the UK, and not Ireland.

- The start date for this change to the CIS has been delayed to March 2021 (from October 2020).

For more information, see:

- CIS reverse charge – common questions.

- HMRC: VAT – reverse charge for building and construction services.

- Download our full processing guide

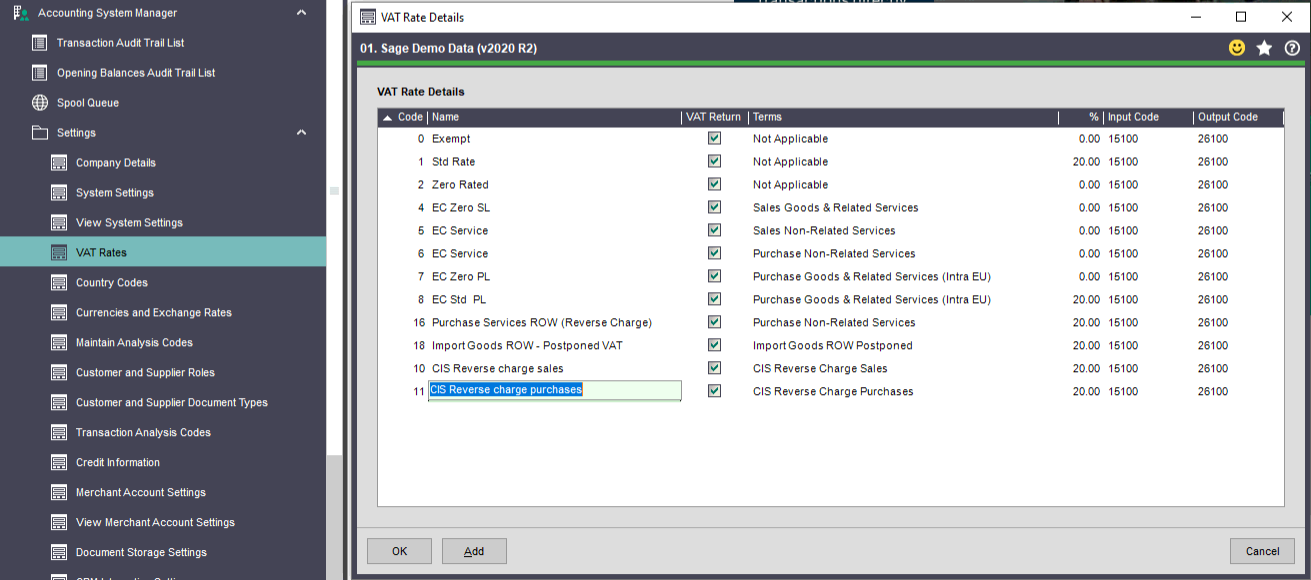

Set up this VAT rate

If you buy or sell construction services that are affected by the CIS, you should set up reverse charge VAT rates for the CIS.

These VAT rates have not been set up for you. To set them up:

- Set the VAT rate Terms to CIS Reverse charge sales or CIS Reverse charge purchases.

Typically you might set up four VAT rates, for sales at 5% and 20%, and purchases at 5% and 20%.

| Code | Name | VAT Return | Terms | % |

| Enter a unique code. | Enter a unique name. | Select the VAT Return box. | Select CIS Reverse charge sales. | Enter your local tax rate, for example 5% or 20%. |

| Enter a unique code. | Enter a unique name. | Select the VAT Return box. | Select CIS Reverse charge purchases. | Enter your local tax rate, for example 5% or 20%. |

- Specify Input Code and Output Code nominal accounts, if you want to override the Default VAT Input and Default VAT Output tax nominal accounts in the company’s default nominal accounts.

What happens when I use a CIS reverse charge VAT rate?

- The tax rates are used for accumulating values for the CIS reverse charges on the VAT Return.

- CIS Reverse charge sales affects box 6 of the UK VAT return, and has no effect on the Irish VAT return.

- CIS Reverse charge purchases affects boxes 1, 4, 7 of the UK VAT return, and T1 and T2 of the Irish VAT return.

- When you print invoices and credit notes that contain items using the CIS reverse charge VAT rates, a message will added to the footer of the document to indicate that a reverse charge is applicable. The HMRC recommends that this text is included on invoices and credit notes that are eligible for CIS reverse charge VAT.

You can select the message to display on the Invoice Printing tab in Invoicing Settings or SOP Settings. See Invoice printing.

- When you enter a sales order, invoice, or a bill, the items cannot contain a combination of VAT rates used for CIS reverse charges with any other VAT rate above 0% (zero).

If you try to use this combination of VAT rates, you’ll see the warning: This document can’t contain items that use this combination of VAT rates. The VAT rates for CIS can’t be used in combination with any other VAT rate that is above 0% (zero).

- If you have customer accounts that are set up to use consolidated billing, separate invoices will be produced to group orders that use CIS reverse charge VAT rates and any other VAT rate that is above 0% (zero).

Tip: For customers or suppliers in the CIS, it’s a good idea to set their account to use a CIS VAT rate by default. To do this, set the Default VAT code on their account Trading tab.

Century can assist if required by importing new default VAT rates against customers and/or suppliers. If you require this, please send us two Excel lists, one containing customer account number and the new VAT rate code to set against them and a separate file for suppliers in the same format.